Not known Factual Statements About P3 Accounting Llc

Wiki Article

Our P3 Accounting Llc Statements

Table of ContentsRumored Buzz on P3 Accounting LlcP3 Accounting Llc Fundamentals ExplainedIndicators on P3 Accounting Llc You Need To KnowGetting My P3 Accounting Llc To WorkHow P3 Accounting Llc can Save You Time, Stress, and Money.

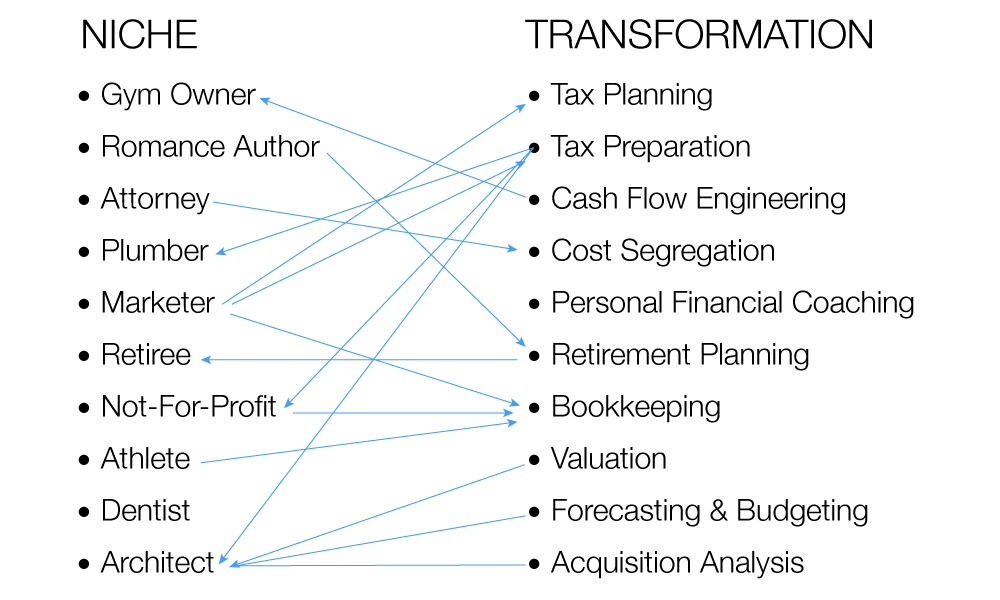

We have a group of over 200 experts with diversified backgrounds. We concentrate on providing accountancy services to expert solution companies. We offer greater than two dozen specialized sector practice teams with deep understanding and broad experience in these industries: Literary Providers; Agencies; Modern Technology, Net, Media and Enjoyment; Building; Production, Retailing and Distribution; Maritime, and Cost Segregation Groups.By Kimberlee Leonard Updated March 04, 2019 Accountancy firms offer a myriad of services that assist entrepreneur stay financially organized, tax obligation certified which help get ready for service growth. Local business owner shouldn't take a look at an audit firm merely as an outsourcing cost for bookkeeping however as an indispensable company companion.

While some accounting firms focus on particular niche solutions such as tax strategy, most will certainly offer bookkeeping and pay-roll services, tax prep work and business evaluation services. There is a lot more to strain preparation and prep work than finishing tax obligation returns, although accounting firms prepare both state and government corporate income tax return. Bookkeeping companies also prepare year-end organization files, such as internal revenue service proprietor K-1, staff member W-2 and 1099-Misc types.

Additionally, local business owner need to establish organization entities that develop most favorable tax obligation situations. Accounting companies assist determine the very best options which aid in the development of entities that make the very best tax obligation feeling for the company. Some estate preparation needs are one-of-a-kind to numerous organization owners, and an audit firm helps identify these.

Rumored Buzz on P3 Accounting Llc

Companies will deal with estate planning attorneys, economic organizers and insurance representatives to execute long-term methods for organization transfers and to reduce estate taxes. Several entrepreneur are excellent at supplying the service or product that is the foundation of the company. But entrepreneur aren't constantly experts at the financial elements of running an organization.Copies of organization bank accounts can be sent to audit firms that collaborate with accountants to maintain exact money flow documents. Bookkeeping companies also produce revenue and loss declarations that break down essential locations of costs and earnings streams (https://experiment.com/users/ibowden). Accountancy firms also might assist with balance dues and take care of outgoing cash that consist of vendor settlements and payroll handling

Bookkeeping companies are integral when a company needs to create evaluation records or to acquire audits that funding companies need. When a service seeks a lending or financing from a private investor, this purchase requires to be legally and properly valued. It is likewise needed for possible mergings or acquisitions.

Some audit companies additionally assist new businesses with pro forma monetary declarations and projections. OKC tax credits. Pro forma financials are used for preliminary funding or for organization development. Audit firms make use of sector information, along with existing company economic history, to compute the information

Examine This Report about P3 Accounting Llc

The Big 4 likewise supply digital transformation getting in touch with to offer the needs of firms in the electronic age. The "Big Four" refers to the 4 largest audit firms in the U.S.The largest bookkeeping firms used to comprise the "Big 8" yet mergers and closures have decreased the variety of leading tier firms.

Arthur Youthful combined with Ernst Full Report & Whinney while Deloitte Haskin & Sells combined with Touche Ross to reduce the team count to 6. Rate Waterhouse and Coopers & Lybrand combined their practices, making the total five.

The Ultimate Guide To P3 Accounting Llc

The large majority of Ton of money 500 business have their financial statements audited by one of the Big Four. Big 4 customers include such business powerhouses as Berkshire Hathaway, Ford Motor Co., Apple, Exxon Mobil, and Amazon. According to a 2018 record by the CFA Institute, 30% of the S&P 500 were investigated by Pw, C, 31% by EY, 20% by Deloitte, and 19% by KPMG.With 360-degree sights of business and industries, the Big 4 are authorities in business. They have substantial recruiting and training programs for fresh grads and offer prized channels for tax obligation and consulting specialists to and from various commercial industries. Each Big 4 firm is a composition of private professional solutions networks instead than a single company.

The Greatest Guide To P3 Accounting Llc

Despite overall regardless of growthFirm Deloitte's 2021 United States revenue declined earnings Decreased. 1 billion, the second highest possible amount for Big Four companies however only up 2% (in its neighborhood currency) from the year prior.

Throughout monetary year 2021, Ernst & Young reported approximately $40 billion of company-wide profits, a rise of 7. 3% compound yearly development over the past 7 years.

Report this wiki page